|

I have a client that closed on a home last Wednesday. They discovered a leak behind the wall yesterday morning. Kyle advises me to have them reach out to their hazard insurance provider. The insurance company said that if it is a pre-existing condition it most likely won’t be covered. There is mold present, so I’m positive that it is pre-existing. Do we have any sort of recourse on our end to hold sellers accountable?

Hey, Owen. Unfortunately, our agency ended at close of escrow so other than advising the buyer on the contract (ie: Sec 5a, 6a and 7a), or on the escrow process, this is now a buyer/seller matter. Most likely the buyer (owner) will need to correct/repair the issues and take the cost of the project up with the court system or a real estate attorney. The contract and other disclosures favor the Seller in these situations unless the Buyer can prove that this was a patent (known or not hidden) versus a latent (unknown) defect. I'd make sure the Buyer has a copy of the purchase contract, Buyer Advisory, etc. Hope that helps!

meant to say "and if they can prove that the Seller knew there was mold and didn't disclose it" - good luck!

Well, I never thought I would run into this issue but I am working with two separate buyers who are in the market for basically the same home in the same area. It's only a matter of time before they both want to write an offer on the same property. What is the best way to handle this? Unfortunately representing two buyers on the same property would create a conflict of interest for both you and the brokerage, so you will have to choose one to work with and refer the other out to another agent. It would be impossible for you to be objective, remember our fiduciary duty requires us to disclose all material information to our client and you would have to disclose to each party that you are writing an offer for the other party and the terms of the offer(s). This would create liability and legal exposure for the agent and the losing party could file complaints with ADRE, AAR alont with possible legal action as well.

I represent the buyer in a transaction and we just received the seller's response to the BINSR. Seller will not do any of the requested repairs. Per contract seller agreed to treat any termites. However, she did not agree to it in the BINSR. If buyer decides he will accept property without repairs and signs the BINSR does seller still have to treat termites because it is in the contract.

Yes, the contract overrides the BINSR, that is, the contract is used as escrow instructions and the BINSR is not. You could open yourself up to the argument that you "re-addressed" it on the BINSR but I still think the contract controls. In the future I would not include anything on the BINSR that has already been agreed to in the purchase contract.

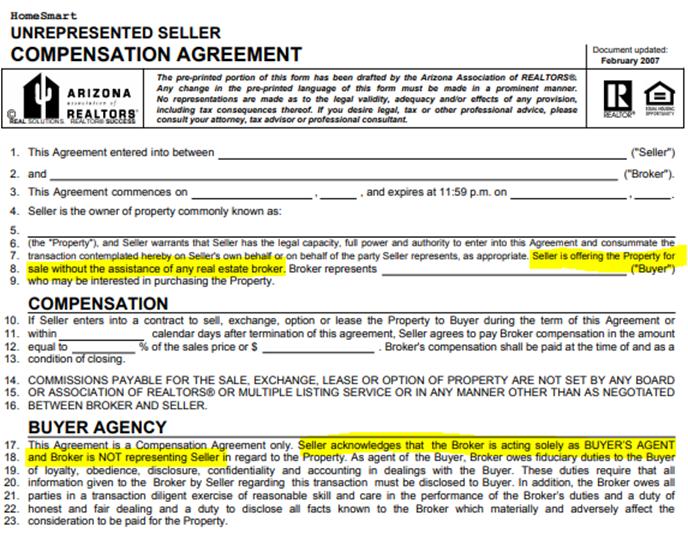

Just to make sure we’re all on the same page and giving consistent responses, when a FSBO seller is paying the buyers agent compensation, we have the FSBO sign the Unrepresented Seller Compensation Agreement. The HomeSmart Declination of Representation form is not required in this case (see screenshot). The disclosure/unrepresented language is already included on this AAR document.

If the FSBO seller is not paying compensation and the Selling Agent is being paid by the buyer (Buyer Broker Employment Agreement), that is when we will require the FSBO seller to sign the Declination of Representation. This has always been our policy. Otherwise, signing both is redundant and would create unnecessary paperwork for our Agent(s).

|

|

I have a request to meet a managing member of an LLC. She gave me indepth details on the improvements of the property she would like to sell. I looked up the LLC she gave me as well as the LLC of one of the managing members. With all my research, I do not see her name listed anywhere. How do I go about validating the authenticity of this person, and what is required to be able to list a property held by an LLC?

LLC's are one type of entity made up of members and managers.

Think of the members as the "owners" of the LLC. Think of managers as "those authorized to carry out the work" on behalf of the LLC.

Sometimes the member is also a manager, they are called "managing members" of the LLC.

The "Operating Agreement" outlines the authority and responsibilities of the members and/or managers, including who is authorized to sign on behalf of the LLC.

So, based on your question, you should ask for a copy of the operating agreement or ask the parties to see who is authorized to sign on behalf of the LLC. Title will want a copy of all LLC documents to confirm signatures and authorized signers.

Hope this helps, call with any further questions. Jeff.

Hello Jeff,

Yes, the minimum compensation offered may be a percentage or a fixed dollar and may not be a fraction of either. This is written in Rules and Regulations Rule 12.1 Cooperative Compensation Specified on Each Listing, first paragraph. https://armls.com/docs/armls-rules-regulations.pdf

No conditions on compensation may be offered within the MLS per the Inappropriate Language Policy https://armls.com/docs/armls-inappropriate-language.pdf

Respectfully,

Jensine Rasmussen ARMLS Data Integrity (480)921-7777 opt. 2

From: Website@ARMLS.com Sent: Wednesday, February 17, 2021 2:24 PM To: DI@ARMLS.com Subject: Website Contact Form: Jeff Tallman jt063- jtallman@hsmove.com - Data Integrity

Hi X, Any time there are a combination of "typewritten" and "hand-written" entry fields the question arises as to whether the handwritten fields were entered at a later time and did the parties agree to the added verbiage/language that was added later...? It's basically a safety net for agents and the brokerage to make sure everything is being agreed to... Hope you are doing well and staying safe. Take care, Jeff. Why is the following necessary? The Listing agreement was completed in person and signed the same date/time any of this was written in? I understand if there was a change or correction needed.

Also, and this is probably a broker question (Brokers, please chime in), should I be listing my PLLC name on the READE form? Should I list my PLLC name in MLS? Should I use it on any contract docs? I have seen it many ways from other agents and brokerages. What is proper to make sure I am protecting myself as well as possible and utilizing the benefits of the PLLC structure?

Hi Chris, it's Jeff from the broker dept, I'll let agent services handle part 1 of your question.

As far as your PLLC goes, that is a limited liability and tax strategy that has nothing to do with your agency relationship or fiduciary responsibilities with your clients. It should not be placed anywhere, not on purchase contracts, not business cards, not on yard signs, etc. At the end of the day it's only the way the brokerage pays you for tax purposes, that's it. The only place it should be visible is when you print your license.

|

|

ADDENDUMSDIPSHIT ADDENDUMS ADDENDUMS FYI - Line 38 is where a Buyer's Agent will list any "Addendums" to the contract. This is not a place to list "Disclosures or Advisories". Please do not list the Agency Disclosure and Election, Consent to Limited Dual Representation, Affiliated Business Disclosure, Wire Fraud Advisory, SPDS, Market Conditions Advisory or Buyer Broker Agreement on line 38 of the Purchase Contract. They are NOT "Addendums". Thank you. |