|

DECLINATION OF REPRESENTATION: You are basically a SCRIBE for the unrepresented buyer! (sellers permission needed to answer some of their questions). DEED. ALL INCLUSIVE TRUST DEED: An All Inclusive Trust Deed (AITD) is a new deed of trust that includes the balance due on the existing note plus new funds advanced; also known as a wrap-around mortgage. A wrap-around mortgage, more-commonly known as a “wrap”, is a form of secondary financing for the purchase of real property. http://www.ocltic.com/Uploads/26/99/12699/Gallery/Flyers/What%20is%20an%20AITD.pdf BENEFICIARY DEED: ALSO SEE LISTING; BENEFICIRY DEED DEED: SUBSEQUENT DEED REVOKES BENEFICIARY DEED: AZRepublic Article, 11/10/2019, by Chris Combs: NOTE: Note: Upon the death of the owner of the real property, a recorded beneficiary deed for the real property takes precedence over a conflicting transfer of the real property by the owner’s will. DEEDS: A special warranty deed is a deed in which the grantor warrants the title against defects in clear title occurring only during their ownership of the property. The grantor of a special warranty deed does not provide a warranty or guarantee against any defects in clear title that existed before their ownership. A warranty deed contains a guarantee that the grantor has legal title and rights to the real estate. A quitclaim deed offers little to no protection to the grantee. ...Warranty deeds ensure that the grantor has the right to sell the property, and guarantees that there are no liens or encumbrances against the land. The most common types of deeds include: 1) general warranty deeds, 2) deeds with limited or no warranties, ie: special warranty deeds. bargain and sale deeds. quitclaim deeds, 3) deeds held by trusts. deed of trust. reconveyance deed. trustee's deed, 4) deeds executed by courts. administrator deeds. executor deeds. master deeds. sheriff's deeds. DEED OF TRUST: https://combslawgroup.com/mortgage-vs-deed-trust/ https://www.legalnature.com/guides/understanding-when-and-how-to-use-a-deed-of-trust#how-is-a-deed-of-trust-different-from-a-mortgage-or-a-promissory-note(See Quick Guide): A deed of trust is a legal document that is the security for a real estate loan. Stated another way, a deed of trust Creates a lien on real estate as collateral for a loan. Mortgage agreements deal with foreclosure through the court system, while deeds of trust handle foreclosure outside of court, which is much cheaper and faster for the parties involved. DEED OF TRUST (VERY GOOD): https://www.legalnature.com/guides/understanding-when-and-how-to-use-a-deed-of-trust#how-is-a-deed-of-trust-different-from-a-mortgage-or-a-promissory-note

DEED: DISTRIBUTION DEED: Q: I just put the above mentioned listing into RSA. The property has a month to month tenant who expressed an interest in purchasing the home. She has a Realtor, qualifies and presented an offer yesterday, which has been accepted by the seller. Tax records list James C Shaw as the owner. He passed away, willing the home to my client, Jennifer O'Neal. Jennifer has spoken to her lawyers about selling the property. It has not yet been transferred into her name, but in response to Jennifer asking about the transfer, the lawyer sent this, " Dear Jennifer, Don't worry about transferring anything regarding the property we will take care of it. I will be filing a Deed of Distribution today with the court along with the Confidential Inventory. This will Deed the house from the Estate to you personally. I will send you a copy of both once they have filed with court." What do I need to know? A: Hi, X: As for the tenant buying the property, that is a fairly common occurrence, but you will still need to set up a full listing file in order to represent the seller. On page 6 of the listing agreement you can write "This is a non-MLS Listing" since the buyer is already in place. All sale paperwork will be as per normal, however sometimes the tenant will waive the SPDS and Insurance History since they have knowledge of the home and have already been living there. You will have to see what their thoughts are regarding that, along with their home inspection requirements. Check with your preferred title company on this "deed of distribution" to see if they will have any additional needs or requirements in order to convey title, or any other potential issues or problems regarding this “distribution deed.” (See the following definition):

A distribution deed is a way to legally transfer real property when the distribution of the property can’t be determined from a person’s will. Usually, the distribution of the deceased person’s home will happen according to their directions contained in their will. If this cannot be determined due to unclear instructions, or if the person never left a will (i.e. they died intestate), a party can obtain a distribution deed which would secure the transfer of the real estate. Basically, the party obtaining the distribution deed then assumes control and ownership of the property.

Also ask the seller to ask her/his attorney to provide all required documentation showing seller(s) legal standing to convey the property along with any timelines needed for court approval or if disclosure language should be added to the purchase contract, such as: “This contract is subject to Court Approval no later that xx/xx/xxxx. If approval is not received by this date, this contract shall be automatically cancelled and all Earnest Money shall be immediately returned to the Buyers.”

DELAY CLOSING, DUE TO VANDALISM: Q: I'm representing the buyer. I just received a call from the listing agent regarding the home that we are scheduled to close on tomorrow. She informed me that she was checking on the property and there seem to have been some vandalism to the property. I'm not sure of the extent yet. If the items can't be fixed today, should I delay closing? What other steps do I need to take? Any suggestions? A: Are you and the Buyer going to be able to go by to assess the "damage?" I don't think you can make a decision until you know what happened. The seller is obligated to deliver the home in the same condition as it was on the date of contract acceptance, plus they need to update the SPDS (see section 4f of the PC). Also, if the damage is extensive, will the seller be filing an insurance claim? The bottom line is to asses the damage and discuss with the buyer, if it's extensive I think an Addendum delaying/extending COE could be necessary. Request the updated SPDS right away, if they don’t deliver that quickly then send a CURE notice. SEND WRITTEN INSTRUCTIONS TO TITLE SIGNED BY THE BUYER TO DELAY CLOSING UNTIL FURTHER NOTIFIED! DELAY INSPECTION: “The date of X written notice to Y that X has Z shall be deemed the date of contract acceptance for purposes of all applicable contract time periods. Buyer shall promptly open Escrow and deposit Earnest Money as described in the Contract upon receipt of written notice of Sellers Replacement Property Contract Acceptance.”

DELAYED STATUS: “NEW” JULY 19, 2018 DELAYED STATUS: INTRODUCING DELAYED STATUS:

DELAYED LISTING: Q: This may seem a silly question, but not sure about Delayed listing rules. I have a Delayed listing on the MLS right now, scheduled to go active August 1st. A buyer took a look at the home prior to me entering into the MLS and has now made an offer. If we accept, do I just change the active date to the date we go under contract, then change the status again to UCB? A: I talked to the folks at ARMLS, you are correct. Put the listing back to ACTIVE and then make the change to UCB or PEND. DELETED PORTIONS OF THE CONTRACT OR ADDENDA, BRING BACK INTO EFFECT: “All deleted portions of the Purchase Contract are hereby reinstated and in full force and legal effect.” DEMOGRAPHICS: Sep 29, 2019 - Demographics is the study of a population based on factors such as age, race, and sex. Demographic data refers to socio-economic information expressed statistically, also including employment, education, income, marriage rates, birth and death rates and more factors. Demographics are characteristics of a population. Characteristics such as race, ethnicity, gender, age, education, profession, occupation, income level, and marital status, are all typical examples of demographics that are used in surveys. DEPARTMENT OF FINANCIAL INSTITUTIONS: ARIZONA DEPARTMENT OF FINANCIAL INSTITUTIONS http://www.azdfi.gov/Licensing/Licensing-FinInst/Licensing-FinInst.html http://www.azdfi.gov/ DEPOSITS, RENTAL DEPOSITS, SEE RENTAL STUFF CASE STUDY DISABILITY, ARIZONA CENTER FOR DISABILITY LAW: https://www.azdisabilitylaw.org/wp-content/uploads/2016/04/FHA2-Assist-Animals-and-FHA-FAQ-112415.pdf DISCLAIMER; SEE NON-SOLICITATION CLAUSE... Disclaimer and Quit Claim Deeds-- http://ellsworthfamilylaw.com/consequences-of-disclaimer-deeds-or-quitclaim-deeds-in-arizona-divorces/ DISCLAIMER DEED: (Also see “One Spouse Buying Without the Other”) Q: What is the name of the disclosure form to use when a spouse will not be on an offer (title)? Thank you, A: Hey Renee, the spouse will have to sign a Disclaimer Deed which will come during the escrow. There's really no disclosure, but you could put on page 8 that the Seller is aware that the Buyer is married, but purchasing this property as his sole and separate property. Have a great evening! KF DISCLAIMER DEED: SPOUSE: ONE SPOUSE BUYING WITHOUT THE OTHER LANGUAGE: BUYER: “James Brown, a married man, as his sole and separate property.” Then on page 8 line #344 additional terms, write in something like this: "James Brown agrees to deliver/provide a disclaimer deed signed by his spouse Mrs Edith Brown, regarding this property, no later than_____." OR This agreement is contingent upon the non-buying spouse signing a disclaimer deed within 72 hours of contract acceptance....OR...Buyer agrees to provide a disclaimer deed within no later than or within xx hours of contract acceptance

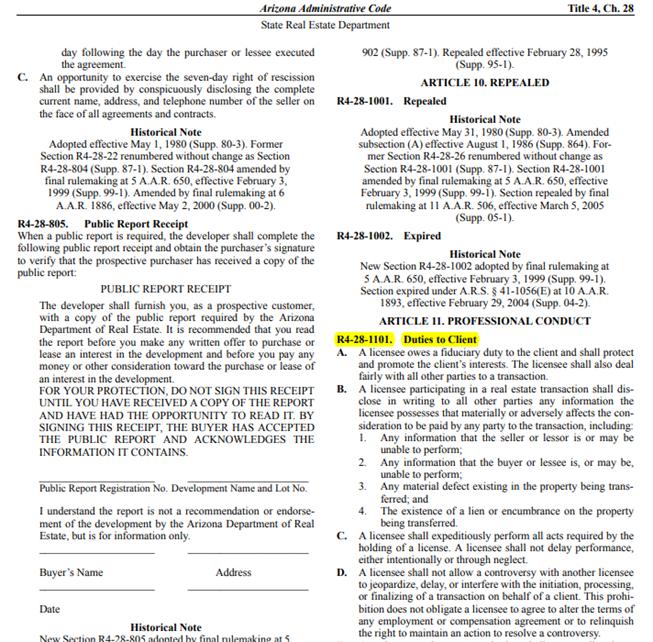

DISCLAIMER DEED:Consequences of Disclaimer Deeds or Quitclaim Deeds in Arizona Divorces; Ellsworth Family Law https://ellsworthfamilylaw.com/2020/03/12/consequences-of-disclaimer-deeds-or-quitclaim-deeds-in-arizona-divorces/ DISCLOSURE: You Could Be the Fall Guy for Your Seller’s Lies! Q: We are residents of Estrella. Recently there was a meeting held by the association that discussed the ongoing situation between the HOA and the Developer (Newland Communities) regarding the deteriorating condition of the common area walls in certain communities. The board did issue an updated letter (see attachment) of the most recent events and direction moving forward. A broker with Realty One forwarded the letter to AAR Legal Counsel, Rick Mack for review. We have been told that Mr. Mack’s recommendation is to provide the Estrella Letter as an attachment to the Seller Disclosures when representing a seller or to the Buyers as full disclosure of the most recent facts when working in Estrella. https://magazine.realtor/law-and-ethics/feature/article/2018/09/you-could-be-the-fall-guy-for-your-seller-s-lies?om_rid=AAFBp8&om_mid=_BbpAbVB9sgDxz4&om_ntype=NARWeekly DISCLOSURE: Failure to disclose is the number one complaint filed against licensees with ADRE and a top ranking reason for lawsuits related to real estate transactions. NOTE: You can’t disclose what you have no knowledge of. Two classes of misrepresentation: 1) unintentional misrepresentation = mistake, 2) intentional misrepresentation = fraud! (Concealment of a pertinent fact to induce someone to act to their detriment). DISCLOSURE: IS NOT SPECULATION, POSSIBILITY, NOTHING DEFINITIVE, Disclosure Disputes (Latent Defect-Unknown) http://www.lynchlegalfirm.com/Articles/Arizona-Real-Estate-Disclosure-Disputes.shtml DISCLOSURE REQUIREMENT, COMMISSIONERS RULE: There is a Commissioner’s Rule known as AAC (Arizona Administrative Code) R4-28-1101b that states that a licensee shall disclose anything that could materially or adversely affect the consideration to be paid by any party to the transaction to all parties in the transaction in writing before close of escrow. This includes any RED FLAGS! DISCLOSURE, COMMISSIONERS RULE: There is a Commissioner’s Rule known as AAC (Arizona Administrative Code) R4-28-1101b that states that a licensee shall disclose anything that could materially or adversely affect the consideration to be paid by any party to the transaction to all parties in the transaction in writing before close of escrow. In this case, unless the seller has some written instructions otherwise from their legal representative, you should let the seller know you are also bound to disclose. Remember, disclosure trumps discovery, so we would rather "err" on the side of caution then to be accused of not disclosing known, material information. DISCLOSURE: Q: The seller is asking me if I have a legal obligation to disclose that someone walked into their property and tried taking their refrigerator and from that, it cause a kitchen fridge line water leak? We were under contract on 2826 W Northview, but when they reviewed the spds, they got scared away bcz how the seller presented it. Am I, the sellers agent required to disclose to the buyers agents and buyers that I know that someone tried stealing the sellers refrigerator and when they pulled it, the water line broke and cause a water leak? A: The leak absolutely needs to be disclosed. There's no question about that. The break in and moving of the fridge, is different, and the Seller should be advised to seek the advice of an attorney. If it were me, I would say in an email to my Seller that to be safe, disclosing the crime should be disclosed. That said, he can seek legal counsel to find out if it's absolutely mandatory. It's possible that the stigmatized property law would protect him from liability, but it's also possible that this crime wouldn't fall under that protection, in which case the break in would absolutely need to be disclosed. That's why he should seek the advice of an attorney about the situation if he doesn't want to disclose. KF DISCLOSURE: DISCLOSURE TRUMPS DISCOVERY! SELLER MUST DISCLOSE MATERIAL INFORMATION! Sellers are obligated by Arizona common law and case law to disclose all known material facts about a property to the buyer. Hill v. Jones, 151 Ariz. 81, 725 P.2d 1115 (App. 1986). The SPDS serves not only to inform buyers, but it can also protect the sellers from future legal action. Lawyers who deal with residential real estate transactions widely report that the most common source of lawsuits is nondisclosure. What must a seller disclose? Under Arizona law, if the seller of real property knows of facts or latent defects that materially affect the value of the property, and that are not readily observable and are not known to the buyer, the seller is required by law to disclose those facts to the buyer. Disclosure trumps discovery! A latent defect is a fault in the property that could not have been discovered by a reasonably thorough general inspection before the sale. (Also called hidden defect). What Can Happen to a Seller Who Violates Arizona’s Disclosure Requirements? The buyer may pursue legal action for failure to disclose, fraud, or misrepresentation (intentional or negligent). The buyer may be awarded substantial monetary damages. Or, in unusual cases, a court may void the contract and returned all property or money back to the original parties, as if the purchase never occurred.

Updating the Disclosure Statement If information contained in the SPDS changes after delivery to the buyer, the seller has a duty to disclose this new information. An update to the SPDS might be required. (See Changes During Escrow Section of PC) So please remember, it’s always best to disclose!

DISCLOSURE, (SEE LEGAL HOTLINE ARTICLE) SELLERS OBLIGATION TO DISCLOSE TO BUYER: Updated May 2016: A seller of real property has certain disclosure obligations to the buyer. These disclosure obligations originate from both common law (case law) and statute. A seller has a duty to disclose facts materially affecting the value of the property that are not readily observable and are not known to the buyer. This duty was delineated by the court in Hill v. Jones, 151 Ariz. 81, 725 P.2d 1115 (App. 1986).

The Seller’s Statutory Duty to Disclose: In addition to the common law duty to disclose, there are an ever-increasing number of specific disclosures that sellers are required by statute to make, such as: 1) Lead based paint disclosure in pre-1978 properties (Title X), 2) Swimming pool barrier disclosure (A.R.S. § 36-1681(E)), 3) PUD/Condo disclosure information (A.R.S. § 33-1806 & 33-1260), 4) Notice of soil remediation (A.R.S. § 33-434.01 & 49-701.02), 5) Disclosure affidavit for land in unincorporated areas, except subdivided (A.R.S. § 33-422), 6) Military airport (A.R.S. § 28-8484) (public airport information at A.R.S. § 28-8486), 7) Subdivision disclosures/public reports (e.g., A.R.S. § 32-2183). The Arizona Association of REALTORS® (“AAR”) Seller’s Property Disclosure Statement (“SPDS”) is designed to assist sellers in making these legally required disclosures and to avoid inadvertent nondisclosures of material facts. The first page of the SPDS is a Seller Advisory to help educate sellers about their disclosure obligations and to assist sellers in completing the form.

DISCLOSURE OBLIGATIONS, SELLER: http://www.nolo.com/legal-encyclopedia/arizona-home-sellers-disclosures-required-under-state-law.html DISCLOSURE: Importance of disclosure for both seller & buyer: It is the agents responsibility to counsel their clients on the importance of disclosure and to look for “red flags” that would indicate a need for disclosure. DISCLOSE WHEN BEING COMPENSATED BY BOTH SELLER & BUYER, AND THAT SELLER/BUYER IS LICENSED REAL ESTATE AGENT IN ARIZONA: “Seller/Buyer acknowledges that Seller/Buyer is an Active Licensed Real Estate Agent in the state of Arizona and is representing him/herself in this transaction.” OR “Buyer is a licensed Real Estate Agent in Arizona and is part of the purchasing entity.” OR “xxx, Buyer, is a licensed Real Estate Agent in AZ” OR “This Addendum is for disclosure purposes only: Buyers Agent is related to the Buyer.” DISTRESSED PROPERTIES….HOW FIND? SEE CASE STUDIES…...FSBO COMPENSATION, HOW TO FIND DISTRESSED PROPERTIES?

DOCUMENT RETENTION POLICY: You can find that information in the HomeSmart Policy and Procedures Manual, first item in table of contents, page six (6), Arizona Dept of Real Estate. 5 yr, 1 yr, 3 yr, agent too! DOMAIN NAME: If an agent is going to use the word HomeSmart in a domain name, it must be the first word in the domain name and must be separated with a hyphen. Please see page 18 of the HomeSmart Policies and Procedures manual for a written explanation. DOMESTIC WATER WELL USE ADDENDUM: DWWA, ALSO SEE ADDENDUM ON FORMS PAGE: Contract Review Note: You have submitted a Domestic Water Well/Water Use Addendum to your file. Please be sure the Seller provides the Buyer with a completed AAR Domestic Water Well SPDS per lines 8-11 of the Addendum and upload the fully executed copy to your file. Thank you! DO NOT CALL: Court Says that Ringless Voicemail Messages are TCPA Calls! http://www.kleinmoynihan.com/court-says-that-ringless-voicemail-messages-are-tcpa-calls/ DO NOT CALL: COMPLY WITH THE DO NOT CALL REGISTRY: https://www.nar.realtor/window-to-the-law/comply-with-the-do-not-call-registry DO NOT CALL REGISTRY-SAN (subscription account number) https://telemarketing.donotcall.gov/profile/create.aspx SAN NUMBER—NATIONAL DO NOT CALL REGISTERY—TELEMARKETING: Q: Does each individual HomeSmart Agent need to apply independently/individually for a Profile with this organization or is there sufficient group coverage thought our HomeSmart coverage? If so, how does this work? I want to order some people listings for target marketing. A: Good Morning X, You can access the Don Not Call Registry by going to https://telemarketing.donotcall.gov/ The username will be 10139601-50602 and the password is Homesmart2021! (which does have an exclamation point at the end). You'll also need to select Downloader. **Please note that you cannot copy/paste the password. Let us know if you have any other questions. Agent Services 3/5/2021 DO NOT CALL: https://www.donotcall.gov/faq/faqbusiness.aspx DO NOT CLL: NAR FAQ’S: https://www.nar.realtor/legal/complying-with-federal-regulations/do-not-call-registry/faq DO NOT CALL, REPORT UNWANTED CALLS, REGISTRATION, ETC; https://www.consumer.ftc.gov/articles/0108-national-do-not-call-registry#unwanted DO NOT CALL: CAN I CALL FSBO’S? Do the new rules apply to calls made to FSBO’s? There are two instances when a real estate professional would call a FSBO seller. The first would be a real estate professional seeking of a FSBO listing, and the second would be a buyer's representative who believes his/her client might be interested in a FSBO property. A buyer's representative can contact a FSBO owner whose number is listed in the Do-Not-Call registry about a client's potential interest in the property, as this call is not a telephone solicitation by the buyer's representative. Note that the buyer's representative can only discuss his/her client's interest in the property and not use a purported client's interest as a way to also discuss the possibility of the FSBO owner listing his/her property with the buyer's representative.However, a real estate professional would be prohibited from initiating a telephone call to a FSBO seller whose number is listed in the Do-Not-Call registry in an attempt to obtain a listing. The rules prohibit anyone from making telephone solicitations to telephone numbers that are registered in the database, and a call initiated to obtain the listing falls within that definition. DO NOT CALL: CAN I CALL EXPIRED LISTINGS?: Can I still call Expired Listings? The established business relationship exemption permits the listing agent as well as other agents from the same company to contact the seller for up to 18 months after the expiration date. For all other agents, the Registry must be consulted prior to calling. If the seller has placed their number in the Registry, you should refrain from calling them.DO NOT EMAIL: (See Case Study on page 53) CAN-SPAM Act: A Compliance Guide for Business: Do you use email in your business? The CAN-SPAM Act establishes requirements for commercial messages, gives recipients the right to have you stop emailing them, and spells out tough penalties for violations. https://www.ftc.gov/tips-advice/business-center/guidance/can-spam-act-compliance-guide-business DO NOT TEXT: Text Message Spam is Illegal https://www.consumer.ftc.gov/articles/0350-text-message-spam It’s illegal to send unsolicited commercial email messages to wireless devices, including cell phones and pagers, unless the sender gets your permission first. It’s also illegal to send unsolicited text messages from an auto-dialer — equipment that stores and dials phone numbers using a random or sequential number generator. Exceptions to the law: 1) Transactional or relationship types of messages. If a company has a relationship with you, it can send you things like statements or warranty information. 2) Non-commercial messages. This includes political surveys or fundraising messages.DO NOT: HOW TO OPT OUT: Stopping Unsolicited Mail, Phone Calls, and Email https://www.consumer.ftc.gov/articles/0262-stopping-unsolicited-mail-phone-calls-and-email DO NOT MAIL: email response to upset recipient of mail: Q: I meant to touch base with you yesterday. I received a call from an owner at 9318 E. Crystal Drive in Sun Lakes. The gals name was Marcy Meyer, and she was adamant that she wanted to be taken off of your mailing list. I let her know that if you're farming that area that it may be tough to remove a single address from a mailer, but that I would let you know to please try :) Anyway, she sounded pretty frustrated because she doesn't like getting those cards, so if you could try to have that address skipped (if that's even possible) that would be great. A: Yes, I can do that because I target expired and cancelled listings. I wish she would have contacted me directly because I could have taken her off immediately. Thanks for letting me know DOOR KNOCKING: Q: Hi Jeff, do you know of any agents who do a lot of door knocking that are successful at it? If so I would love to hopefully meet with them and get some advice, thanks! A: don't know of any off the top of my head, but if I come across anyone I'll let you know. I know it can be challenging, many homeowners are very confrontational to anyone that knocks on their door uninvited. Many neighborhoods also have "no trespassing" signs and consider that to be a form of trespassing. Someone knocked on my own door Sunday, they wanted to alert me to an open house they were doing in the area… Be cautiousif you do it, like I said may people will get right in your face and consider you to be trespassing on their property. DRUNK DRIVING: Q: Is this going to affect my ability to be a license real estate broker in AZ? My long term plan is to practice on a more 50-50 basis within the two states in the next 5 years. A: Hi X, These are questions for ADRE, my response or input would be speculative at best. I recommend that you reach out to them through their message center at this link: https://www.azre.gov/ You can ask direct, detailed questions and someone with detailed knowledge will respond. 602-771-7700 DUAL AGENCY: Also see agency: The dual agent cannot advise on purchase price, the terms of the offer or negotiate on behalf of either party. You cannot advocate on behalf of one to the detriment of the other. Ask questions. What to you want me to ask? Say? Tell? You become more of a facilitator. KEEP REPEATING: “THIS IS WHAT THE CONTRACT SAYS.” You can still administer the pc! DUAL AGENCY: Disclosure Must Be Signed By Both Buyer And Seller: 9/10/2017, CHRIS COMBS https://www.combslawgroup.com/dual-agency-disclosure/ DUAL LISTING: ALSO SEE ARMLS, DUAL LISTINGS: SPLIT, CAN BE LOT AND LAND WHEN GOING TO BE SPLIT...OR BOTH FOR SALE AND FOR LEASE: Q: I currently have 10 acres with fix up home listed as residential. The seller is going to split the property and list as a vacant 5 and 5 with the home. Do I need 2 new listing contracts? Or can I use the existing listing I have? If so where do I specify the list price of each new 5 acres?A: You will need a separate listing agreement for the vacant 5 acre parcel that is being split from the main 10 acres. Obviously, a buyer will use the vacant land/lot purchase contract for this parcel. This is allowed as per MLS Rule 8.6.(e): DUAL LISTINGS. Only one Listing for each property may be FWA by or on behalf of the Listing Participant, except under the following circumstances: (e) The property is for sale as a single parcel or it may be divided and is available for sale as multiple smaller parcels. DUAL LISTING (BOTH FOR SALE AND FOR LEASE): Q: I have a home listed for sale and it expires in October 2018. The seller apparently has also listed the home with another brokerage as a rental. The HOA in the community called me to tell me this. Is this ok? A: A seller/landlord is allowed to have a sale listing with one brokerage and a rental listing with another brokerage for the same property. While that could certainly create some difficulties, it is allowable. Q: Interesting and yes it creates some difficulties, but we have a signed listing agreement! On the the listing agreement I am reading seller is to compensate listing broker for the listing fees, if they rent, sell etc with another brokerage or make a deal to sell, outside of listing agreement. A: The ER can be for the sale, rental, or both for the same property. If your ER is for the sale, then you have the right to be involved in the sale. If another brokerage has the ER for rental, then you will not be involved with that and no commissions would be due to you. The owner should disclose this to you upfront so you can make an informed decision as to whether or not you want to take the listing or not and the details regarding that (cancellation provisions, for example). It should also be disclosed in the MLS that the listing is available for both sale and lease and cross-reference the MLS #'s. Duties To Client: R4-28-1101

|

|

DURESS: CLOSE UNDER DURESS: email, MTennyson 10/30/2020: Letter to Listing Agent and Title Co:

Dear X: (backstory): I have been hoping to hear from you by now since the Buyer Pre-Closing Walkthrough form was delivered early yesterday. Time is of the essence as this transaction is scheduled to close tomorrow. This has been a challenging transaction and I have worked hard to keep it moving forward after the appraisal came in at $515,000, $45,000 below original purchase price. The buyer agreed to pay $526,500, $11,500 over the appraised value, and I agreed to give up my entire commission of $13,500. to satisfy the seller's need to get $540,000 for the home, or $25,000 over the appraised value.

As noted in the Buyer Pre-Closing Waltkthrough, the agreed upon repairs to the HVAC units were not completed in a satisfactory, workmanlike manner. The main floor unit is still leaking and on 10/27/20 tested 4-5 pounds low on R-22 refrigerant (photos and a report from the HVAC tech were sent yesterday). The Buyer has the right to expect this will be resolved appropriately. We recognize that it may not be possible to complete the repairs prior to tomorrow's close of escrow. Please know that the Buyer is closing under duress and will seek further actions should the leak and low refrigerant level matter in the main floor HVAC unit not be resolved by close of business 11/10/2020, with receipt provided to Buyer as proof of completed work. |

|

See Security Title: Ways To Hold Title In Arizona In Title Section:

COPIED |