|

LOAN CONTINGENCY, PURCHASE CONTRACT: FINANCING Section 2b. Loan Contingency: Buyer’s obligation to complete this sale is contingent upon Buyer obtaining loan approval without Prior to Document (“PTD”) conditions no later than three (3) days prior to the COE Date for the loan described in the AAR Loan Status Update (“LSU”) form or the AAR Pre-Qualification Form, whichever is delivered later. No later than three (3) days prior to the COE Date, Buyer shall either: (i) sign all loan documents; or (ii) deliver to Seller or Escrow Company notice of loan approval without PTD conditions AND date(s) of receipt of Closing Disclosure(s) from Lender; or (iii) deliver to Seller or Escrow Company notice of inability to obtain loan approval without PTD conditions. LOAN CONTINGENCY: CASE STUDY, TITLE WILL NOT RELEASE EM DUE TO LOAN DENIAL, WE ARE WITH BUYER: DEMAND LETTER TO TITLE: Good Morning X, At our agents request, I called and talked with you briefly regarding this a little over a week ago...you were going to follow up with your admin team to see where they were at in their decision process. My understanding from our agent xyz is that you are offering our client only half of their EM? Why is there still any question or delay regarding refunding the FULL EM to the buyer? The contract is clear in sect 2b that the buyers obligation to complete this sale is contingent upon Buyer obtaining loan approval without PTD conditions prior to COE. Section 2c states that "This contract shall be cancelled and Buyer shall be entitled to a return of the EM if Buyer is unable to obtain loan approval without PTD conditions and delivers notice of inability to obtain loan approval." The buyer did receive a loan denial and the Unfulfilled Loan Contingency was submitted. I have attached both of those again here for your reference. I am requesting again that you immediately release the full EM to the buyer, the purchase contract authorizes you to do so. Otherwise, we will have no choice except to encourage the buyer to file a complaint with the appropriate regulatory agency (AZDFI). Thank you for your help, we look forward to a favorable response. LOAN DENIAL; CASE STUDY, KF, 2/26/2020: BUYER DOESN’T HAVE TO JUMP THROUGH A THOUSAND HOOPS! Q: I have had a few different conversations with you guys over the last week regarding this specific transaction, but wanted to give you a status update to ensure we are still handling things correctly. This transaction is scheduled to close escrow this Friday the 28th. On Monday, the Buyers were informed for the first time by their lender that they would be unable to complete their loan. That prompted my email that evening to the title company noting that they would not be able to close, and that the earnest money should be returned to the Buyers based on the contract loan contingency language. You can see the response that we received from the Sellers agent. Thus far, the title company has yet to respond. Yesterday, at the request of the Sellers agent, we put the Buyers in touch with a lender that she recommended in hopes that the new lender would be able to pull the loan together. We should get confirmation one way or another on that today. I want to make sure I am protecting the buyers $10K EM. Back Story: (Sent email, Loan Denial) See attached. Unfortunately, the buyers lender on the above transaction confirmed this afternoon that they are unable to fulfill the loan as they had originally stated. Please use this email as the Buyers request to cancel the transaction due to insufficient loan progress, and process Buyers earnest money for return to Buyers. Other agents response: Please do not release the earnest money to the buyer. The Seller is asking for release to them, as the buyer did not make a "diligent and good faith effort". Their lender informed them they could try another investor if they got an extension, of which the Seller was prepared to give. Furthermore, they spoke with my lender who said based on what the buyer told him, he would be able to get them the financing. Our agents response: My preference would be to keep this email thread away for a prolonged back and forth disagreement on what constitutes a good faith effort. Contrary to what is noted below, the Buyers did make every effort to work with their lender to fulfill the loan conditions, and were told 3 days prior to closing by the lender that they would not be able to get the loan. That was the first point they had any formal indication that there was a barrier to completion. Immediately committing to another lender is not a requirement to achieving a good faith effort. Especially when our discussions this week have revolved around not wanting to issue an extension due to the Sellers same day closing on another property. That being said, my hope is that this is all irrelevant. You have now confirmed that the Sellers may be open to an additional 3-4 week extension, allowing the Buyers sufficient time to work with your recommended lender to get a new loan in place. The prior lender has shared all information received to date with the new lender, and they are assessing their ability to fund the required loan. Before we further the discussion around disbursement of earnest money held by title, let's wait for some feedback from the new lender and then confirm path forward. A: Good Morning Chad, yes from what I can see you're handling it correctly. The buyer is under NO obligation to jump thru a thousand hoops to try to prove to the Seller that they gave a diligent and good faith effort. The brokers email is fine, but it's not correct. It doesn't matter that the Seller would be willing to grant an extension or that there may be other financing options available to the Buyers, the contract is contingent upon the loan that's described in the Prequal form or the LSU, whichever came later. If the Buyer can't get THAT loan, they're able to cancel and should receive a refund of their EM. KF. LOAN DENIAL: ALSO SEE “UNFULFILLED LOAN CONTINGENCY” & “UNFULFILLED LOAN CONTINGENCY NOTICE” LOAN DENIAL, FINAL SOFT CREDIT PULL: See sample loan denial letter in doc’s tab: Tania, the loan officer told me that they had to resubmit for another clear to close. And possibly need to do it again after finding out about the $300 purchase price reduction which she was never told about.. I just wanted to keep you on the loop. The loan amount has been updated and the loan remains under review for the lease hold. I just requested an update. Also a new CD will be issued and send to Lynn for review. This email is to inform everyone that due to recent credit issues discovered on the final soft pull. The loan will be denied. The official denial letter will be sent as soon as my compliance dept issues it. LOAN DENIAL AND RECEIVED CURE NOTICE FROM UPSET SELLER (WE REPRESENT BUYER) “SEE UNFULFILLED LOAN CONTINGENCY NOTICE” Roger I want the ernest money because buyers did not come through on the loan. I also want the money for all repairs made that I was told I had to do to close on the house. All of this money came out of my pocket. Kyle, Thanks for your help today. I did not receive the decline letter from Wells Fargo as promised. Was told by loan officer at 5:30 pm their system was down but they were working on it. I did receive the email below and the attached cure notice. Can you please call me when you get this email? Have also not experienced a cure notice in my 11.5 years as a Realtor. Faye, I'd write something like the paragraph below, send it to Roger, and CC the escrow officer. I'm trying to soften the statements, because you don't want to sound defensive, while at the same time letting him know that you're Buyers most likely have the better case here. Take care, KF. “Hi Roger, I understand the Sellers frustration, and trust me, the Buyers feel the same way. As you know there was no indication that this was going to happen until yesterday. It was dropped in all of our laps at the same point. That being the case, there's no way that the Buyer should lose their earnest money in this case. They did everything they were supposed to do, and the lender came back with a denial very late in the process. I wish that weren't the case, but here we are. Your Cure Notice references that the Buyers are in non-compliance with section 2b of the contract, which was true until the Unfulfilled Loan Contingency form was delivered. At that point we met our contractual obligation and the earnest money should be refunded. Again, we all want to be able to move forward with the deal and close on Friday. Unfortunately that won't be able to happen given what the lender said.” LOAN OFFICER, NMLS: NMLS stands for the Nationwide Mortgage Licensing System and Registry. NMLS is a web based platform for regulatory agencies to administer initial license applications and ongoing compliance requirements. LOAN OFFICER LICENSE INFORMATION http://www.loanofficerlicense.net/arizona-loan-officer-license-requirements/ Q: Can an agent be a loan officer? NO. See AGENT, LOAN OFFICER. LOAN STATUS UPDATE (LSU): CASE STUDY, SEE CASE STUDIES, LOAN STATUS UPDATE NOT SIGNED ON LINE #40 LOAN STATUS UPDATE (LSU): PC, Section 2e: Loan Status Update: Buyer shall deliver to Seller the LSU with at a minimum lines 1-40 completed, describing the current status of the Buyer’s proposed loan within ten (10) days after Contract acceptance and instruct lender to provide an updated LSU to Broker(s) and Seller upon request. NOTE: Buyer cannot unilaterally change the terms and conditions in the pc by adding new terms and conditions in the LSU, such as adding a Buyer Contingency Addendum, Seller Concessions, etc. Stating Buyer Contingency in Pre-qual does not add that term and condition to the pc! (Buyer Contingency, Concessions, Price, etc) OH SHIT If this happens, issue a CURE notice: “Buyer cannot unilaterally change the agreed upon terms and conditions in the purchase contract by adding new terms and conditions in the LSU (List: xx, xx, xx). Corrected LSU to be immediately re-issued by buyer and buyers lender removing those items as financing conditions.” (Fraud, concealment of a pertinent fact to induce someone to act to their detrement. Not telling something a material fact is the same as lying about it). Ignorance is not a defense for negligence. Improperly written pc. Standard of care. LOAN TYPES: 203K: Q: Can you tell me how to write a contract for a 203 K loan? A: Hi, It is written like all other offers, the buyer may want to ask for additional time for inspections to be able to gather all the quotes for the remodel. The finance contingency still works the same, in addition to section 2l, the contract the will be contingent upon the property appraising for at least the expected market value required by the lender. Q: The Appraisal will need to come in for the offer plus the renovation amount? A: Diane, follow up with the lender to clarify. My understanding is that the appraisal will use either the "AS IS" or "After Repair" method. So, the renovation could be included. LOCKBOX, ALTER LOCKBOX ACCESS TIMES: http://armls.com/alter-lockbox-access-times LOCKBOX WHEN TENANT OCCUPIED PROPERTY: Requires written permission from tenant plus CBS code enabled on lock box. Tenant hereby gives permission for the listing agent, xyz and HomeSmart to have a lockbox on the property at 123 Main St, Phx, AZ, where tenant currently resides and occupies the premises. It is also agreed that prior to utilizing the lockbox, xyz realtor will contact tenant for permission prior to entry. The lockbox CBS code will be set between the hours of x and x and will only be shared with the express permission of the listing agent. LOCKBOX: ALSO SEE ARMLS, SUPRA, ACTIVE KEY: (2/26/2019) Q: How do I change lockbox access times? A: You must bring your boxes into one of the ARMLS support centers and they will change the access times, or, you can use your EKey. Q: How do I access the “End of Showing” time? A: You must program this using your EKey, not an ActiveKey. LOCKDOWN COMMISSION: SEE COMMISSION LOCKDOWN LOGOS: You can have a personal, branded logo. It can’t look like you are a real estate company. Must have HomeSmart too. The HS on logo doesn't prominently identify the employing broker. Thank you! Hi Beth, While you and I certainly know what the Diamond stands for, many consumers do not. Therefore, when we use the Diamond we must also include the word HomeSmart. Please make that change and resubmit...Also, please feel free to call with questions. NOTE: You can use the Words Without the Diamond. LOVE LETTERS: SEE CASE STUDY, PAGE LUCK: But luck, as they say, falls on those in position to receive it. (Roger Federer) LUCK: A quote by Seneca: “Luck is what happens when preparation meets opportunity.” LUXURY MARKETING: YARD SIGN, $750K threshold for luxury marketing. MAIDEN NAME: Q: My clients Jason Bailey and Nancy Beardsley a married couple are on the deed of their home. They now want to sell and Nancy has legally changed her name to Nancy Bailey. Should she sign all documents with Nancy Beardsley as she purchased the home or her new legal name Nancy Bailey? A: She should sign with her legal married name, but can note that Nancy Bailey and Nancy Beardsley are one in the same in the purchase contract so there's no issues with that. Also, check with title in advance as they may have other specific requirements or proof of name change at prior to signing documents. MAKE IT HAPPEN: It had long since come to my attention that people of accomplishment rarely sat back and let things happen to them. They went out and happened to things.” Have you ever heard this quote from Leonardo da Vinci? WOW – way to put it all into perspective in one sentence. Do you want to be successful? A person of accomplishment? I guarantee the majority of people would say yes. But, when you think about yourself and what you are doing to take your career, personal life, goals, etc. to the next level, are you going out and making it happen? Or, are you just doing a good job and waiting for good things to come along and find you? Because let me tell you; you may be a great person with big aspirations for your life, but good things don’t always come your way. Look at examples of those who have “made it”. Do you think any famous athlete, actor, musician or millionaire sat back and hoped for amazing opportunities to come their way? Of course not! When there is a dream or goal at stake, the only way to bring it to life is to go out into the world, and happen to things. MANAGE CLIENTS EXPECTATIONS: XYZ, nice talking with you this morning. Managing our clients expectations is probably one of the more difficult things we have to deal with, especially when those expectations may be unrealistic. The end result is usually some type of conversational which may seem a bit confrontational and the way I like to handle that is to be proactive, make it happen sooner rather than later, get it over and done with, get it resolved, move past it. I'm sure things will work out fine with your client. As for being there to deliver the keys, nothing says we have to be there in person, I would just make sure to touch base with them to ensure they did get access after closing, and follow up again when you return from vacation. JT MANUFACTURED/MOBILE HOMES: Q: Are we allowed to sell manufactured homes that sit on leased land? When I first went to real estate school (back in the dark ages!), we were told they were not considered “real estate” and we were not allowed to sell them with a regular real estate license – you needed a “dealership” license to sell them. I’m only asking, because I’m seeing quite a few of them in MLS, and just wondering why they are allowed into our MLS system if we can’t sell them. A: Hi Margaret, the laws recently changed in regards to this issue. If the manufactured home is in a mobile home park agents used to not be able to sell them, but now they can. That being said, we are telling agents that unless they've been to some classes or something in order to educate themselves about the process, we'd rather they refer out the deal since it's a whole different contract with different terms. Q: Are we licensed to sell these homes in parks? A: HomeSmart policy does not allow our agents to be involved in these types of transactions. It is a completely different set of paperwork, plus our E&O coverage is different than traditional residential transactions. That being said, we do have an agent who is "testing" this area for HomeSmart. Do you have a specific client, or just wanting to know for future reference? Q: I had a possible referral. So I thought I would check in. We can sell them if affixed, correct? Just not in parks? A: Yes, affixed plus the land conveys is ok for agents to be involved with...Selling in parks where the land does not convey means selling "personal property" vs "real property” and HomeSmart has not approved that as of yet. MARKET CONDITIONS ADVISORY: SHOULD MY CLIENT SIGN? Q: was in rCRMS class the other day and we were instructed that the new Market Conditions Advisory (rev. 02/2021) is not meant to be a shared document between buyer and seller. Is my understanding correct? Is there any reason why I should not sign the same MCA as the seller? If so, how should I address this. A: This form is basically an "FYI" or "Advisory" to your client and is not to be considered an "Addendum" to the PC. You can elect to have your client sign but it is not mandatory and it is not required to be signed by both seller and buyer. It is an Advisory to your client, nothing more, no agreement between the parties. MEMBERSHIP: WHAT DO I HAVE TO DO GO JOIN ANOTHER ASSOCIATION AND/OR MLS? See doc in google docs.”HomeSmart Association Memberships” Plus sample Letter of Good Standing. Q: I am hoping to activate my license in Flagstaff as I have clients looking there. Can you tell me how I go about doing this? A: Hi X, Your license is good for the entire state, but if you mean that you'd like to access the MLS in Flagstaff, you'd need to join their Northern Az Assoc. of Realtors first. All you'd need to do is contact them to find out what that process looks like, and then once you've done that, you can inquire about joining their MLS. In order to have a secondary membership up there, your license will have to be out of either the Corporate office, Arrowhead office, or Biltmore office. If you're out of any other office, just reach out to Agent Services and they can assist in switching branches. Have a great day! KF. OR Your license must hang with one of our branches that is a member of the white mountain association. Agent services can help you with that move as well. You would also need to notify your local association that your license has moved to a different branch, they have a form that needs to be signed for that. MENTORSHIP PROGRAM: Please take note of the email below as it relates to our HomeSmart Mentorship program, contact information, etc. The new Mentorship Manager has officially started and we will need to start directing all mentorship related questions/inquiries to her. If you haven't had a chance to meet her, her name is JJ (Jeannie Johnson) Bourdos and she is pretty awesome! She is a 1099 employee so she will not be in the office full time. Her schedule is Tuesday-Friday 8am-Noon. We also have a new email address and phone number for the mentorship department. The new number is 602.889.2565 and the new email is Mentorship@hsmove.com. Her direct in-house extension is 2196. Please do not give out her in-house extension or her personal email address. We are trying to make sure she can keep her personal real estate business separate from HomeSmart's mentorship program. MENTORSHIP PROGRAM: Q: I am a new agent that will potentially be helping out a client on their home purchase. The home is a new build and I was hoping to get some assistance on negotiating my first deal, best practices for working with new builds, and assistance writing up the contract. I have a few questions that I hope someone might be able to answer. A: Hi X, You can call us or email us with any specific questions...please feel free to reach out anytime. You can send an email to this address (broker@hsmove.com) or call 602-889-2115 Monday through Friday from 8am-5pm. For after hours or on the weekends, follow the prompt to connect with the on call after hours broker. Are you aware of or have you considered joining our mentor program whereby you would be paired with an experienced agent who would work closely with you on your first few transactions...? This is a great way to gain experience and have someone who would be available to work directly with you and assist you with writing contracts, listing agreements, etc. If you are interested, please reach out to JJ Bourdos who heads up the mentorship program, her email is Mentorship@hsmove.com. I have also copied her on this email. In the meantime, please let us know if you have any questions. MENTORSHIP: Good morning, Since these will be your first transactions, I have forwarded your email to our mentorship department as it appears you will need detailed guidance and support for both your sale and purchase. We strongly encourage new or inexperienced agents to partner with a mentor as this is a proven way to learn the processes and gain experience, plus it reduces the legal risks and liability for both you and HomeSmart. METH LABS, DEA https://www.dea.gov/clan-lab/index.shtml http://www.npr.org/sections/health-shots/2015/07/01/416452137/buy-a-meth-house-unawares-and-pay-the-health-consequences MILLENIAL: denoting people reaching young adulthood in the early 21st century. "most social networking groups are dominated by the millennial generation" Baby Boomers: Born 1946-1964 (54-72 years old) Generation X: Born 1965-1980 (38-53 years old) Millennials: Born 1981-1996 (22-37 years old) Post-Millennials:Born 1997-Present (0-21 years old) Generation Z (or Gen Z), also known by a number of other names, is the demographic cohort after the Millennials. Demographers and researchers typically use the mid-1990s to mid-2000s as starting birth years. There is little consensus regarding ending birth years. There is little consensus regarding ending birth years. Most of Generation Z have used the Internet since a young age and are comfortable with technology and social media. MILLENIALS: 4 Ways Millennials Are Changing the Real Estate Industry (click for link to article) RIS Media, house call, 10/19/161. Millennials Prefer to Rent2. Millennials Search for Themselves3. Millennials Seek Out Small, Efficient Spaces4. Millennials Don’t Shop Around for Real Estate AgentsMINISTERIAL DUTIES, Be truthful and honest to all parties (+ your fiduciary duties), OBIDIENCE only to client, not customer! MISC INCOME: WHAT IS MISC INCOME? Q: When agents are providing miscellaneous services for consumers, like consulting or marketing, do they use a standard agreement, or write their own? Are these transactions processed just like a sale/referreal etc. in the RSA system? A: From time to time an agent will be compensated for what we call "miscellaneous" services or misc income. That could include services performed such as: Providing CMA’s, BPO’s and Pricing Information, Referring Lenders, Inspection Companies, Home Warranty Providers, Title and Escrow Companies, Appraisers, Pest Control Companies, Tradesmen, etc. There is not a specific form for this. An agent would submit a written request outlining the services they performed for the client to the closing department. Agent would also attach a check payable to HomeSmart and request that be processed as miscellaneous income. The agent should reach out and talk to the broker department before agreeing to this with a prospective client. MISC INCOME: Q: A prospective seller has offered to pay for my services rendered. What is the procedure and requirement in doing so? In this particular case, I have spent many hours discussing, researching, and preparing a CMA twice in the past 6 months. I have also taken her to various properties to show her what her competition would be, plus to have a good idea market value in her area. I also walked through her home room by room, to help her with staging and giving her suggestions on what makes a house a home and would make it saleable. I do understand that the check would need to be made payable to HomeSmart but was uncertain as how to explain the check when I send it in. A: We would need to process it as miscellaneous income. You will need to send an a written request outlining the services you performed for the client, for example: CMA, BPO, Pricing Information, Lender Contact and Information, Inspection Companies and Contact Information, Home Warranty Companies and Contact Information, Title Company and Contact Information, Appraisers and contact information, etc. Please submit to the Closing department and let them know this has been approved by a broker. You will also attach the check from the seller payable to HomeSmart. This is separate and apart from any title company paperwork. This would be between you and the seller, title would not be involved. You would attach the check to your outline of the services you provided and send that to our commission dept and ask them to process that as misc income. OR: Miscellaneous Income: You will need to send an a written request outlining the services you performed for the client, for example: Referring for property management services, preparing CMA, BPO, Pricing Information, Lender Contact and referral, Inspection Companies, Home Warranty Companies and Contact Information, Title Company and Appraisers information, etc. Please submit to the Closing department along with the check payable to HomeSmart. You would attach the check to your outline of the services you provided and send that to our commission dept and ask them to process that as misc income.

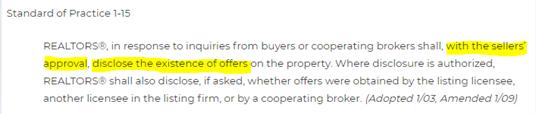

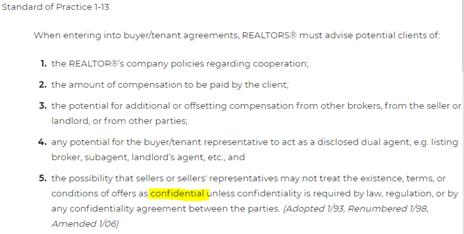

MISSING PAPERWORK: So, yes, we do need the missing paperwork and copies of any emails that were sent requesting it. I don’t have any old emails requesting the SPDS, if you need it I can email and request...? I don’t believe I’ve ever been asked to prove it or I would have saved the email. Just state on the missing paperwork form that you don't have any emails re: SPDS Please submit an addendum or at a minimum the missing paperwork form to the file stating what you have said here in your email. MISSING SIGNATURES ON DOCUMENT IN TRANSACTION FILE: Complete a missing pw form stating something like "Addendum #1 is hereby considered null & void as the parties were not in agreement" (Or one party refused to sign, whatever). If the file ever gets audited by ADRE, the written explanation will be there to answer the question. Q: I uploaded the cancellation letter from the title company some time ago. I also just sent it over again. This is all we have for this sale cancellation. The BINSR was accepted at the time by the Buyer, but when the Buyer went to sign loan docs at title on the day before closing, the husband would not sign. Therefore, the sale did not go through and the earnest deposit was forfeited to the Seller. The agent does not have anything else from the Buyer. The Buyer will not sign any documents from us. A: You will need to upload the Missing Paperwork form (HomeSmart form) and state on the form what you have stated here in your email. We will then cancel the file. Just need that explanation in the file in case the file is ever audited by ADRE. MISSING PAPERWORK LANGUAGE: LISTED BELOW IS THE REASON I DID NOT TURN THE PAPERWORK INTO HOMESMART: Sellers/Buyers agent ceased all forms of communication. No reasons or explanations were given. CURE notice was sent on xx/xx/xxxx and we received no response. Escrow was not opened, Earnest Money was not deposited. Please cancel this transaction in the HS system so we can get the property back on the market. Thank you. MOBILE HOMES: Q: Can agents sell mobile homes? A: If it’s attached to the land and the land conveys with the sale of the MH, that would be a fairly routine transaction and HomeSmart agents would be able to list those. If it's on leased land in a mobile home park, that would be a different story. We don't want our agents involved with those unless they have documented experience processing the paperwork involved with that. Those contracts are not AAR documents and E&O may not apply unless you have verified experience with those. Our recommendation is to refer those out to someone experienced and who has listings in that park. there are special documents for mobile homes located in parks. Please contact Diane Rusnak at 602-=881-7689 for more information regarding that. https://www.aaronline.com/manage-risk/legal-articles/fillable-forms/ MONTH TO MONTH: Q: I was curious if someone is in a month to month lease and the owner wants to sell would they just give the tenant a 30 day notice and then they would have to vacate? A: Jordana, on a month to month lease, notice to terminate is given 30 days prior to the periodic rental due date. So if rent is due on Sept 1 for the month of September, notice would also be given on Sept 1,,,MONTH TO MONTH: By neither party giving notice, the lease has extended on a month to month basis. MORTGAGE DEBT FORGIVENESS ACT CLICK HERE MORTGAGE FRAUD ON THE RISE! 6 Types of Mortgage Fraud Are Becoming More Prevalent. Mortgage fraud climbed 12.4% year over year in the second quarter of 2018, and about one out of every 109 mortgage applications has been found to contain false or misleading information, according to data firm CoreLogic. Read the 6 most common types here. http://enews.realtor.org/a/tBbrTbGB8hVyFB9s0iAAAFBp8QW/featured MORTGAGE LOAN ORIGINATORS: Can Realtors originate Mortgage Loans? http://nationalmortgageprofessional.com/news/22398/can-real-estate-agents-originate-mortgage-loans MORTGAGE: ARIZONA Mortgage Loan Originators License http://mortgage.nationwidelicensingsystem.org/slr/PublishedStateDocuments/AZ-MLO-New-Application-Checklist.pdf MULTIPLE CONTRACTS: From AAR article (docs tab Q&A): Q: Is a buyer entitled to enter into multiple contracts without informing the sellers with the intent to buy only one, since the buyer can cancel the contracts during the inspection period in the buyers sole discretion? A: No. The buyer must act in good faith and deal fairly with the seller. MOVE-IN/MOE-OUT CHECKLIST: SEE RENTAL PAGE STUFF MULTIFAMILY HOMES: WHAT TO KNOW MULTIPLE OFFERS AND WHAT TO DISCLOSE https://www.nar.realtor/search-results?qu=multiple%20offers

MULTIPLE OFFER/COUNTER OFFER: Q: Just a quick question about an offer I received on my listing from another HS agent. They mentioned they are putting an offer in on two homes at the same time and will go with the best offer for her client. Is this something we can actually do? Seems a little strange. Thanks. A: Hi Jesse, You can do that but if and only if you use the Multiple Offer/Counter Offer form which is on zipForms. It's a lot more than just a "mention" that they are doing that. Also, you better let the other agent know she should add that form to her clients offer immediately (the other offer too). She could find herself in a real conundrum if she gets two accepted offers and both sellers play hardball and refuse to let her cancel one… MULTIPLE COUNTER OFFER: SELLERS FINAL ACCEPTANCE; by Seller signing page 2 of the MCO under "Seller's final Acce[tance" states that Seller is moving forward with this buyer and all MCOs the seller has sent to other potential buyers are revoked. It is not referring to counters between the seller and the buyer named on this MCO. MUTUAL CANCELLATION “Buyer and Seller mutually agree to cancel the purchase contract dated xx/xx/xxxx. Earnest Money shall be immediately (released to seller or refunded to buyer).” |