|

TITLE ISSUE, NAME ON TITLE INCORRECT: Q to Attorney: It was just discovered today that my client, Joanna G. Schroth, is not on the Tax Roll for the property, which I sold to her in 2018. Left a message at your office to call me at your first opportunity to explain and clarify to what has happened; since the names are very similar, but obviously different identities, we will look forward to restoring the title back into my client's name. Attorney Response: Sorry I was in trial yesterday and have several appointments this morning. My client, Lora Bolick, was appointed guardian/conservator of her Mother, Joan Schroth. As part of that process the Court ordered that restrictions be placed on Ms. Schroth’s property and recorded. It appears the recorder messed up by having that cover Joanna G. Schroth. We are happy to do what is needed to restore title back, whether that be a deed or someone speaking with the recorder to have them correct their mistake. QQ: Good Morning, Jeff, thank you for your assistance yesterday with the legal question about my listing. Since I was in the middle of getting it ready to list, can you please let me know if I can go ahead with plans to put it in the MLS until we find out what's going on. AA: Good morning Daryn, I would not advise moving forward with the listing in any manner until the title issue is resolved. The way it stands now, the seller will not be able to deliver clear title and will not be able to close escrow, and title would also not close under those circumstances. It's unfortunate, but those items need to be cleared up before the seller can move forward. Do you have any preliminary information from the seller regarding that yet...? TITLE COMPANIES: REGULATED BY ARIZONA DEPARTMENT OF INSURANCE AND FINANCIAL INSTITUTIONS; https://difi.az.gov/producers/title-agent TITLE: Recorded Document Search (Maricopa County Recorder), ie search property ownership like Lowell Spencer: https://recorder.maricopa.gov/recdocdata/default.aspx https://recorder.maricopa.gov/recdocdata/getrecdataresearch.aspx?searchtext=20180944441 TITLE: Always ask title if they require anything else..? Further information, documents, etc. WHAT DO WE SEND TO TITLE? COPIES OF EVERYTHING!!! Cures, notices, addendums, all of it. See sect 3d, line #140-141. TITLE AND ESCROW, WHO CHOOSES , SELLER OR BUYER? This is negotiable between buyer and seller as long as seller is paying the “owners policy” for the buyer. This is traditional/standard/as per normal in Arizona real estate transactions. Our recommendation is that you do not lose the transaction over the title company. Q: I will be writing an offer this week. A couple of the homes my client is considering the notes say an Escrow is already open at a title company. How should I proceed? A: Many agents use the "escrow already open at xyz title..." to try to influence you to use that title company in your transaction (see section 3a in the purchase contract). However, it is negotiable, your client is free to select whichever title company they wish when you submit your offer. TITLE: WAYS TO HOLD TITLE IN ARIZONA CLICK HERE TITLE AND VESTING: Also see sole and separate, disclaimer deed, Section 3b, Title and Vesting: Buyer will take title as determined before COE. If Buyer is married and intends to take title as his/her sole and separate property, a disclaimer deed may be required. Taking title may have significant legal, estate planning and tax consequences. Buyer should obtain independent legal and tax advice.

Section 3c. Title Commitment and Title Insurance: Escrow Company is hereby instructed to obtain and deliver to Buyer and Seller directly, addressed pursuant to 8s and 9c or as otherwise provided, a Commitment for Title Insurance together with complete and legible copies of all documents that will remain as exceptions to Buyer’s policy of Title Insurance (“Title Commitment”), including but not limited to Conditions, Covenants and Restrictions (“CC&Rs”); deed restrictions; and easements. Buyer shall have five (5) days after receipt of the Title Commitment and after receipt of notice of any subsequent exceptions to provide notice to Seller of any items disapproved. Seller shall convey title by warranty deed, subject to existing taxes, assessments, covenants, conditions, restrictions, rights of way, easements and all other matters of record. Buyer shall be provided at Seller’s expense an American Land Title Association (“ALTA”) Homeowner’s Title Insurance Policy or, if not available, a Standard Owner’s Title Insurance Policy, showing title vested in Buyer. Buyer may acquire extended coverage at Buyer’s own additional expense. If applicable, Buyer shall pay the cost of obtaining the ALTA Lender Title Insurance Policy.

TITLE ISSUES: CANCEL, HOW CANCEL? Note on BINSR or cancel after 5 days of receipt. “Title Issues, Cloud on Title. Seller is unable or unwilling to deliver clear title.”

TITLE, COMMON WAYS TO HOLD TITLE: (SOLE AND SEPARATE, MARRIED, COMMUNITY PROPERTY, JOINT TENANCY, ETC) http://www.fntic.com/commontitle.aspx TITLE INSURANCE: WHY DO YOU NEED TITLE INSURANCE? http://www.fntic.com/whyneedtitle.aspx NEW HOME: https://www.firstam.com/title/homebuilder/buyer/ TITLE INSURANCE: FOR A NEWLY BUILT HOME: http://www.firstam.com/title/resources/reference-information/title-insurance-reference-articles/why-do-i-need-title-insurance-for-a-newly-built-home.html TITLE INSURANCE, IS EXTENDED COVERAGE AVAILABLE? Q: I'm completing my continuing education credits and just got through the contract portion on extended coverage title policies. Can you please share with me where that language would go in the contract and what it would look like? I've never specifically asked for any type of extended coverage for my clients, but I'm especially interested in the kind that covers unpermitted square footage and zoning issues since many homes have added family rooms, etc. I think I should start adding this to the contract. Are there any other types of extended coverage you would recommend? Does this mean every policy my clients have been getting has just been basic? TITLE INSURANCE: EXTENDED COVERAGE??? Q: I've not heard of "extended coverage" or what language to use. Any thoughts on this?? Kyle A: I just called and talked to Lisa Figueroa at Equitable Title. There is no extended coverage for the items the agent is asking about (un-permitted square footage or zoning). Also, just an FYI...escrow instructions state that a seller will complete an "owners affidavit" asking about any improvements seller has completed within the last 180 days. If the answer is yes, the seller must provide proof of payment for those improvements. If the seller does not provide proof of payment, those items would be considered exceptions to the title commitment and would not be covered. (This would definitely apply to “flippers.” In AZ, mechanics liens must be filed within 180 days). Jeff. TITLE INSURANCE: IS A MUST BUY: AZ Republic Article, April 28, 2019, Chris Combs: CLICK HERE TITLE INSURANCE: Differences Between Owner’s and Lender’s Policies: Owner’s title insurance protects the owner from claims against the title that predate the purchase of the property, and lender’s title insurance protects the lender. That is the primary difference between the two. In many cases, the coverage provided will be identical, and that is due mostly to the basic kinds of issues this insurance covers being standard, and including the following: NOLO: Definition: (GOOD): https://www.nolo.com/legal-encyclopedia/title-insurance-buyer-needs-36126.html · Debt claims against the property · Contractors’ claims for the cost of work to improve the property · Unknown co-owners or heirs · Tax liens TOOL AND TUXEDO RULE Whether you are working with a buyer or seller, you will most likely have a chance to observe the premises and most often there will be visible clues as to some possible underlying problems. Remember you are NOT doing an inspection as that will be done by a qualified state-certified professional but if you do notice “red flags” such as stains in the ceilings, cracks on the floors and walls, little tunnels, uneven floors, or algae growth in the pool, etc, make a note of them here. Since you are not doing an inspection, you can apply something called the “Tool & Tuxedo” rule that means that if getting access to an area requires the use of a tool (screwdriver, ladder) or would soil the hypothetical tuxedo or evening gown you’re wearing, you don’t check that area out. It is “inaccessible for observation”. TRANSFER: OPEN ESCROW TRANSFER: Q: Can we sign open escrow transfers? A: Yes as long as we have a file for the sale, and also double check if there's a listing for that address since in that case we'd need both the escrow transfer and the listing transfer. Thx Kristin TRANSFER: “TRANSFER TO” HOMESMART”: See File #S1613615: Authorization to transfer listing form goes into referral file when HomeSmart pays out, along with needing W9 and copy of brokerage license.” ? Q on the brokerage license….? What if mhg or rog or whoever? TRANSFER OPEN ESCROWS/LISTINGS: Q: I recently severed my license from Homesmart to another brokerage. I have 1 active listing and 2 pending escrows. I will email listing transfer form today with seller’s approval, but would like to leave the 2 pending escrows at Homesmart. Please let me know how to proceed with closing those. Last time I left Homesmart I still closed them with the help of a transaction manager, will it be the same this time? A: Good Morning Denise. If you want to leave the 2 pending sales here at HS, you'll need to have another HS agent added to the file so that they can manage them thru completion. Who would you like me to add? Q: I dont have anyone in mind. Will that cost an additional transaction fee? A: You can't simply leave them here and continue to work them because ADRE sees that as you working for 2 brokerages at one time. That's why you have to choose one of the 2 options here. So you either have to appoint someone to take them over (and I'm sure that they'll require some sort of fee to do that), or you'll have to transfer the files to your new brokerage. I've attached the form for you to do that if that's the route you want to go. There is a $350 referral to HomeSmart at COE, just so you're aware. TRANSFER FEE, PER RICH 3/1/2021, (fee is not published in P&P manual): The fact is we are not required to release sales when an agent leaves. The commission legally belongs to the brokerage. We are also not required to have a "release fee" in the P&P manual. We do it as a courtesy. Side note: I can assure you this was a simple oversight, I process all severs and file transfers for HomeSmart and this is our standard open escrow transfer fee. We release listing files at no charge with the proper paperwork. TRANSACTIONS COORDINATORS: Must absolutely be licensed in AZ. 1) See ADRE Bulletin in docs tab, 2) See ADRE Substantive Policy Statements regarding unlicensed assistants. Transaction Coordinators must be licensed in Arizona. It is possible to share a transaction coordinator, but all licensees must be members of the same brokerage firm. The ADRE is also seeing numerous incidents of unlicensed assistants completing tasks that require a real estate license. Apr 24, 2015 https://azre.gov/bulletins/Bulletin_05_15.pdf (see page 5) TRANSACTION DESK: HELP: LAUNCH TRANSAC TION DESK VIA SINGLE SIGN ON: Getting started and need some help? We have posted a list of commonly asked questions HERE. (ALSO SEE ZIPFORMS) Get TransactionDesk® support any time you need it 24 hours a day, 7 days a week. Having an issue with TransactionDesk®? Before you call, check the list of ongoing issues being worked on here: TransactionDesk® Project page. Call 800-668-8768 or email TDSupport@lwolf.com any time to get help with any problems you’re experiencing with TransactionDesk®! TRANSACTION FEES: SEE HOMESMART, TRANSACTION FEES Remember, on a sale if there are two HomeSmart selling agents, there is only one transaction fee due to HomeSmart (per side) but both agents will be due the first of year transaction fee of $295. TRANSACTION MANAGEMENT: See HomeSmart Brochure in Doc’s tab under HomeSmart Form, Transaction Management. Also, see Jeri Woodhead at 123456 TRUST ACCOUNT: A trust account is a neutral third-party account established to protect the interests of the parties within a transaction by holding funds until the terms of the agreement call for the appropriate release of funds. TRUST, TRUSTEE: When one spouse dies, the surviving spouse is often designated as the sole remaining beneficiary and is generally named as the surviving trustee, then upon the death of the surviving spouse, property passes to the named heirs.Jul 8, 2014 (Also see signatures). TRUSTS: ARE COMPLEX. PROBLEMS WITH TITLE COMPANY; Q; Sellers are dealing with the title company WFG National Title they have run into issues with, not preparing documents with correct names, confusion with the payment process with a Trust involved. They are not able to receive funds as individuals (their preference), but as co-trustees of the trust, There is no bank account associated with the trust. They are concerned about payment and have asked for a process to change title company if unsatisfied. What is that process? A; Dealing with trusts and required paperwork to properly convey title or distribute proceeds is beyond our scope of expertise...title has their requirements for that and we basically let them do their thing once escrow is opened. You could check with another title co to see if the process would be different, and if the parties agree to change title companies that can be done with written mutual agreement between the parties. Maybe you could escalate within the title co to see if the process is flexible? Jeff. TUCSON LISTING? CASE STUDY: Q: A friend of mine would like me to list her house in Tucson, can I do so? I have worked (in my full my time job) over the Tucson market for over 10 years and have experience in Commercial space and retail space, however have never sold a residential home. Hi, in order to take a listing in the Tucson area what I need to be a member of the Association out there? A: If you are going to do business in Tucson you should be a member of the Tucson Association of Realtors (TAR) and join their MLS. However, if it's just a "one off" thing, you could list the home in Tucson and submit to ARMLS, but then it would only be exposed to agents who are members of ARMLS and not TAR. That might not be in the best interest of the seller, so you will have to talk to them about that. Also, you should be familiar with the area and be aware of any issues or "red flags," the code of ethics says we can't operate outside of our scope or field of expertise and Tucson is certainly outside of our local area. Bottom line is if the seller understands this and is ok with you listing the home and states that in writing (email), you could move forward with the listing. Also remember they use a different lockbox system and compensation is only offered through whichever MLS you submit the listing to. TUCSON: Q: My question is, am I allowed to represent her, show her homes in Tucson and write an offer for her on her new home there? A: Yes we are members there as well, and you're also allowed to represent her down there. If you don't work that market frequently, you need to have her acknowledge in writing that Tucson/Marana is not your area of expertise though. Also, are you saying that you did join the MLS? If so, the commission won't be an issue, but if you did NOT join the MLS yet, you should do that before making an offer since the offering of compensation that's in MLS is only offered automatically to other members. TUCSON: HOW CAN AGENTS JOIN TUCSON MLS…? A: 1) Must hang license at corporate, Scottsdale/Hayden Rd or Gilbert, 2) Join TAR as secondary membership, 3) Join Tucson MLS (you will have limited access with showing privelages, if you want full access and to be able to enter listings you need to reach out to Kristen Armbruster and she will add/approve you to full listing access). TWITTER: Q: I'd like to set up Twitter and Instagram accounts for my identity as a real estate salesperson with HomeSmart; however, I want to make sure those online elements meet HS guidelines for proper naming and identification of the brokerage. Are there example accounts I can view for this purpose? Is this information available under the FAQ section of RSA? A: Tim, You would need to clearly identify yourself as a HomeSmart agent and use the HomeSmart name and logo on your profiles. I do not have any examples, but please send us what you mock up for approval. TWO SIDED BUSINESS CARD: Q: Can I have HS on one side of card and XYZ business on the other side? A: I have given the ok to agents for this in the past, as long as our side of the card meets our requirements (logo, fair housing, etc). TWO CLIENTS, SAME HOUSE: I have 2 clients very interested in the same house....Q: what do I do if they both want to make an offer? Eek! A: Hi X, it would be very difficult and challenging and would create possible legal liability if you were to submit offers from 2 different clients on the same property. You just know the one that loses is going to be upset and create a legal issue. You can’t do both,. Pick the best one, let the other one go. Trudy suggests that you should refer one of the buyers to another agent. You can't represent 2 buyers on the same house at the same time. TM UBIQUITOUS: PEPSICO, WHY PEPSICO USES BRANDED ENTERMAINMENT: IE, MUSIC MARKETING: HERE UNCONDITIONAL LOAN APPROVAL, LETTER TO TITLE TO RELEASE EM TO BUYER: ALSO SEE UNFULFILLED LOAN CONTINGENCY… Good morning Cheryl, At our agents request, I called and talked with you briefly regarding this a little over a week ago...you were going to follow up with your admin team to see where they were at in their decision process. My understanding from our agent Fabiola is that you are offering our client only half of their EM? Why is there still any question or delay regarding refunding the FULL EM to the buyer? The contract is clear in sect 2b that the buyers obligation to complete this sale is contingent upon Buyer obtaining loan approval without PTD conditions prior to COE. Section 2c states that "This contract shall be cancelled and Buyer shall be entitled to a return of the EM if Buyer is unable to obtain loan approval without PTD conditions and delivers notice of inability to obtain loan approval." The buyer did receive a loan denial and the Unfulfilled Loan Contingency was submitted. I have attached both of those again here for your reference. I am requesting again that you immediately release the full EM to the buyer, the purchase contract authorizes you to do so. Otherwise, we will have no choice except to encourage the buyer to file a complaint with the appropriate regulatory agency (AZDFI). Thank you for you help, I look forward to a favorable response. UNDERWATER HOMEOWNERS INFORMATION CLICK HERE UNDERWRITER ISSUES: Q: A Good Morning to all! I wish I could start the day off on an optimistic note, but the lack of detail and communication on this transaction is disconcerting. A: Very simple. We provided the Conditions the underwriter requested last week and we are waiting on the underwriter. I have told you this but you either are not listening or do not like my answer. I was told late yesterday that we will have an answer today. Unfortunately with a brokered loan, I am stuck to their turn times which are not quick. UNFULFILLED LOAN CONTINGENCY: See Veronica Goldberg Process, See PC, One of the Major Contract Contingencies that protects the Buyer. Even if receive CURE Notice, Lender Loan Denial will overrule. (See Loan Denial). Hi (Agent), Per section 2b of the contract, the Buyers have until 3 full days prior to the COE date in order to sign loan docs, notify title of loan approval without conditions and the date that the Closing Disclosure (CD) was received from the lender, or deliver notice of their inability to obtain loan approval without conditions. In this case, the CD has been delivered and the loan has been approved, so the Buyers aren't able to use the financing contingency to walk away from the deal anymore without exposing their earnest money to forfeiture. The loan contingency protects a Buyer in the event they are denied a loan, or they cannot meet the conditions to get approval, but it can't be used to cancel and get earnest money back if the approval has already happened. Take care! UNFULFILLED LOAN CONTINGENCY: PREQUALIFICATION INTEREST RATE: Buyer is unable to qualify for the loan rate initially offered by lender on the buyers pre-qualification. Buyer hereby elects to cancel the contract due to this unfulfilled loan contingency…

CASE STUDY: Buver pre-qualified at an interest rate not to exceed 4.75% on a conventional loan. Unfortunatelv, lender is unable to offer this prequalification rate to the buyers. See attached 1) lender pre-qualification and 2) loan estimate.Buver disapproves of different, higher interest rate than initially pre-qualified for.

UNFULFILLED LOAN CONTINGENCY: Case: Not a loan denial, lender just failed to get the effing loan processed! Title company will make the final decision. Ask lender to mark the LSU no on line #62 and sign and date the form with today’s date.

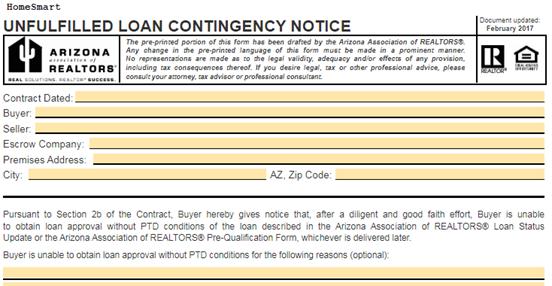

Cancel using UNFULFILLED LOAN CONTINGENCY NOTICE. State the following: (with attachments)

After a Diligent and Good Faith Effort, Buyer is unable to obtain loan approval as required in the AAR Residential Resale Real Estate Purchase Contract, therefore, buyer elects to cancel this contract and requests an immediate refund of their Earnest Money. Section 2b of the Purchase Contract allows the buyer to cancel, and reads as follows: (or see attached).

Loan Contingency: Buyer’s obligation to complete this sale is contingent upon Buyer obtaining loan approval without prior to document (PTD) conditions no later than three (3) days prior to the COE date for the loan described in the AAR Loan Status Update (LSU) form or the AAR Pre-Qualification Form, whichever is delivered later. No later than three (3) days prior to the COE date, Buyer shall either: (i) sign all loan documents; or (ii) deliver to Seller or Escrow Company notice of loan approval without PTD conditions AND date(s) of receipt of Closing Disclosures from Lender; or (iii) deliver to Seller or Escrow Company notice of inability to obtain loan approval without PTD conditions.

This notice satisfies the third condition (iii) above. Also see attached LSU, line #62, “Buyer has loan approval without PTD conditions” is marked no and signed and dated by the loan officer. (If you can get this signed and dated, otherwise, say unmarked or not marked as being approved by the lender). “

“Buyer elects to cancel this contract and requests an immediate refund of their Earnest Money. “

OR, if cancelling due to Formal LOAN DENIAL: “Buyer has received a loan denial from the lender (attached). Therefore, Buyer is unable to obtain loan approval without prior to document (PTD) conditions as required in the AAR Residential Purchase Contract (see section 2b, Loan Contingency (attached). “Buyer elects to cancel this contract and requests an immediate refund of their Earnest Money. “

UNFULFILLED LOAN CONTINGENCY NOTICE: Q: Underwriting told me I’m not approved for a loan, what form do I cancel with? A: Hi X, Whenever we receive a loan denial, we will use the form titled "Unfulfilled Loan Contingency Notice" to cancel. This document is available on both zipForms and Transaction Desk. It is optional to list the reasons on the form, however, for a loan denial I advise writing "See Attached Loan Denial" and then attach/send a copy of the Loan Denial Letter along with the Unfulfilled Loan Contingency Notice form. The title company, seller and/or listing agent may also request a copy of the loan denial letter so be prepared to share that with them. Either way, the contract says you should be entitled to a return of your earnest money with a valid loan denial. Have your Buyer sign and then email the Unfulfilled Loan Contingency Notice to the title company and state the following in your email: “Pursuant to Section 2b of the Contract, Buyer hereby gives notice that after a diligent and good faith effort, Buyer is unable to obtain loan approval without PTD conditions. Please cancel this escrow and refund the Earnest Money to the Buyer.” That’s about it, please call with any questions. JT

If, prior to expiration of any Cure Period, Buyer delivers notice of inability to obtain loan approval, Buyer shall be entitled to a return of the Earnest Money. Buyer acknowledges that prepaid items paid separately from the Earnest Money are not refundable.

UNFULFILLED LOAN CONTINGENCY NOTICE TO RESOLVE CURE NOTICE…..SEE CASE STUDIES……..7) UNFULFILLED LOAN CONTINGENCY NOTICE TO RESOLVE CURE NOTICE

UNINCORPORATED AREAS OF THE COUNTY: Go to county assessor website. Look at the city in the address. It will not have a city, it will say unincorporated. Q: What would you say is the best way to explain why areas in Phoenix have private water companies instead of water provided by the city? A: The reason is because there are certain areas or "pockets" of land within the valley that are considered to be "unincorporated," that is the land has not been officially annexed into a city's boundaries and therefore does not receive city services such as water, sewer, trash, police and fire, etc. These services would be provided by the county or private enterprises, such as a private water company.

UNLICENSED ACTIVITY: 1) See ADRE substantive policy statements, 2) See ADRE Bulletin (under docs tab) See Ariz. Admin.Code R4-28-306 Unlawful License Activity Q: HI All! Last year my husband David Bonnett activated his license so he could assist me in execution of my business. UNLICENSED ASSISTANTS http://www.re.state.az.us/LawBook/Documents/SPS_Documents/SPS_2005.04_Unlicensed_Assistants.pdf UNLICENSED ADMIN, ARMLS: Unlicensed admin. I will need their name, home address, telephone number and email address to request through ARMLS. Non licensed cannot be super users, only added as an admin. Additionally, ARMLS is charging $50 per quarter per admin added. Q: I am interested in hiring someone to handle and manage my CRM where I'm getting many inbound leads. Because this person is not a licensed realtor, how may she be part of this and how am I allowed to pay her? For starters I'd like to test it out and see where it goes. I was thinking if she converted those warm internet leads into solid appointments where they actually submitted an app and were approved and went through me to offer a certain pay. She will be doing this part-time. Are there any legal responsibilities that I should be concerned about if she was hired? A: Please see the attached substantive policy statement from ADRE. Any unlicensed assistant is paid a salary and cannot earn a commission based on productivity. I don't have any recommendations for a "script" but the unlicensed employee could not engage in discussion or dialogue regarding real estate except for general clerical activities. They could set appointments for you but not much more than that, and they cannot talk about any specifics such as commission rates, listing or sales details, and so forth. UNLICENSED BUILDER: https://www.combslawgroup.com/taking-recourse-against-builder-without-license/

UNLICENSED BUILDING, REPAIRS, REMODELING, CONTRACTING WITHOUT A LICENSE, PENALTIES: What are the possible penalties for making improvements/repairs without a contractors license? Here is a link to that information: Penalities could include written citations, cease and desist orders, possible fines up to $2500 per day, etc. I think it would have to be a fairly egregious violation, plus someone would need to be fairly angry or upset to file a complaint, but this is what the law says. 32-1166.01. Citation; civil penalties https://www.azleg.gov/viewdocument/?docName=https://www.azleg.gov/ars/32/01166-01.htm |

|

Hi x, The loan denial is written notice from the lender, but does not cancel the transaction. We need something signed by the buyer cancelling the transaction. Please upload the Unfulfilled Loan Contingency Notice signed by the buyer. This is the document executed by the buyer that is used to cancel the transaction because of the loan denial. The loan denial is notice from lender to buyer, but does not cancel the transaction between buyer and seller. See Attached. Please call with any questions. Take care, Jeff. |